China Evergrande New Energy Vehicle Group Sees Dramatic Surge

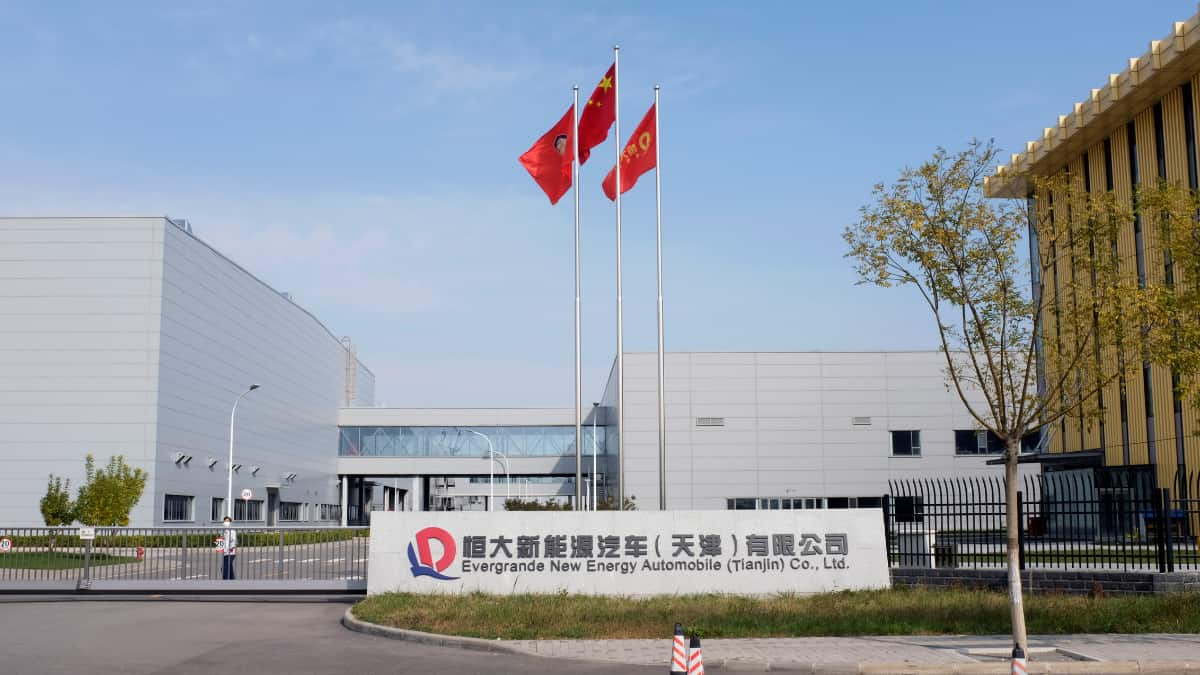

The recent surge in shares of China Evergrande New Energy Vehicle Group marks a notable recovery for the embattled unit amid ongoing financial troubles for its parent company, China Evergrande Group.

Key Highlights:

- Shares of China Evergrande New Energy Vehicle Group more than doubled in value on Monday.

- The surge followed an announcement of a significant stake sale in the electric vehicle (EV) maker.

- The EV unit’s shares jumped as much as 113 per cent, reaching their highest level since September 22.

- Investor optimism was evident after a trading halt that began on May 17.

This price surge was a result of a non-binding agreement facilitated by liquidators on behalf of China Evergrande Group, Evergrande Health Industry, and Acelin Global. The deal involves a third-party buyer taking a 29 per cent stake in the EV unit, with an option to acquire an additional 29.5 per cent.

Financial Support and Business Development:

In addition to the stake sale, the prospective purchaser would provide a line of credit to support the EV unit’s operations and business development, offering a much-needed financial lifeline.

Strategic Move to Alleviate Financial Burdens:

The agreement to sell a stake in the EV unit represents a strategic move to alleviate some of the financial burdens and revive the business. Investors reacted positively to the news, indicating a potential turning point for the beleaguered automaker.

Stabilizing Finances and Market Presence:

The successful completion of this stake sale and the infusion of credit could stabilize the EV unit’s finances, enabling it to resume production and expand its market presence.

This development comes amidst financial pressures faced by the company, including demands for repayment of subsidies and incentives. The stake sale signifies a step towards financial recovery and business revival for China Evergrande New Energy Vehicle Group.